Gaap departure for leases example – Embark on a journey into the intricacies of GAAP departure for leases, a topic that has sparked both intrigue and confusion. This guide will unravel the complexities of this accounting practice, providing you with a clear understanding of its implications and practical examples to illuminate the path.

Delving deeper, we will explore the impact of GAAP departure on financial statements, examining how it affects the balance sheet, income statement, and financial ratios. By understanding these consequences, you will gain a comprehensive perspective on the financial implications of this accounting choice.

GAAP Departure for Leases

GAAP departure for leases refers to situations where a company chooses not to apply the generally accepted accounting principles (GAAP) for lease accounting. This can occur when a company believes that GAAP does not accurately reflect the economic substance of a lease transaction.

Examples of lease arrangements that may result in a GAAP departure include:

- Leases that are structured to avoid classification as a capital lease under GAAP.

- Leases that have unusual or complex terms that make it difficult to apply GAAP.

- Leases that are entered into with related parties.

Impact of GAAP Departure on Financial Statements

A departure from GAAP for leases can have significant implications for a company’s financial statements. These impacts extend beyond the balance sheet and income statement, potentially affecting financial ratios and other key metrics used by investors and analysts to evaluate a company’s financial performance.

Balance Sheet

Under GAAP, operating leases are not recognized on the balance sheet, while finance leases are. However, a GAAP departure may allow companies to recognize all leases on the balance sheet, regardless of their classification. This can lead to a significant increase in both assets and liabilities, potentially affecting key financial ratios such as the debt-to-equity ratio and the return on assets.

Income Statement

A GAAP departure for leases can also impact the income statement. Under GAAP, operating lease payments are recognized as an expense in the income statement over the lease term. However, a GAAP departure may allow companies to capitalize operating lease payments and depreciate them over the lease term.

This can result in a reduction in expenses and an increase in depreciation, potentially affecting key financial ratios such as the operating profit margin and the return on equity.

Financial Ratios

The potential consequences of a GAAP departure on financial ratios are wide-ranging. For example, an increase in debt due to the recognition of all leases on the balance sheet could lead to a higher debt-to-equity ratio, indicating increased financial leverage.

Similarly, a reduction in expenses due to the capitalization of operating lease payments could lead to a higher operating profit margin, indicating improved profitability.

Reasons for GAAP Departure for Leases

Companies may depart from GAAP for lease accounting due to certain advantages and disadvantages. Let’s explore them in detail:

Advantages of Departing from GAAP for Lease Accounting

- Improved financial flexibility:Departing from GAAP allows companies to structure lease agreements that better align with their business needs, providing them with greater flexibility in managing their financial resources.

- Reduced volatility in financial statements:Off-balance sheet accounting can smooth out lease-related expenses, resulting in reduced volatility in income statements and balance sheets.

- Enhanced comparability with non-GAAP peers:Many companies in the same industry depart from GAAP for lease accounting, enabling better comparability of financial performance.

Disadvantages of Departing from GAAP for Lease Accounting

- Reduced transparency:Off-balance sheet accounting can make it more difficult for investors and analysts to assess a company’s true financial position and lease obligations.

- Potential for manipulation:Companies may use lease accounting departures to manipulate their financial statements, making it challenging to compare companies using different accounting methods.

- Increased regulatory scrutiny:Departing from GAAP may attract increased scrutiny from regulators, potentially leading to additional compliance costs and reputational risks.

Case Studies of Companies that have Departed from GAAP for Lease Accounting

Several notable companies have departed from GAAP for lease accounting, including:

- Amazon:In 2019, Amazon adopted the FASB’s new lease accounting standard, which allowed the company to remove certain operating leases from its balance sheet.

- Walmart:Walmart also adopted the FASB’s new lease accounting standard, resulting in a reduction of its lease-related liabilities on its balance sheet.

- Starbucks:Starbucks has been using off-balance sheet accounting for its leases for many years, allowing it to maintain a lower debt-to-equity ratio.

Accounting Treatment for GAAP Departure for Leases

When an entity decides to depart from GAAP for leases, it must select an accounting method to apply to the departure. The two most common methods are the modified retrospective approach and the prospective approach.

Modified Retrospective Approach

Under the modified retrospective approach, the entity restates its financial statements for all prior periods presented as if the new accounting method had always been applied. However, the cumulative effect of the change is reported as an adjustment to the beginning retained earnings of the earliest period presented.

The modified retrospective approach is more complex to apply than the prospective approach, but it provides a more accurate picture of the entity’s financial performance.

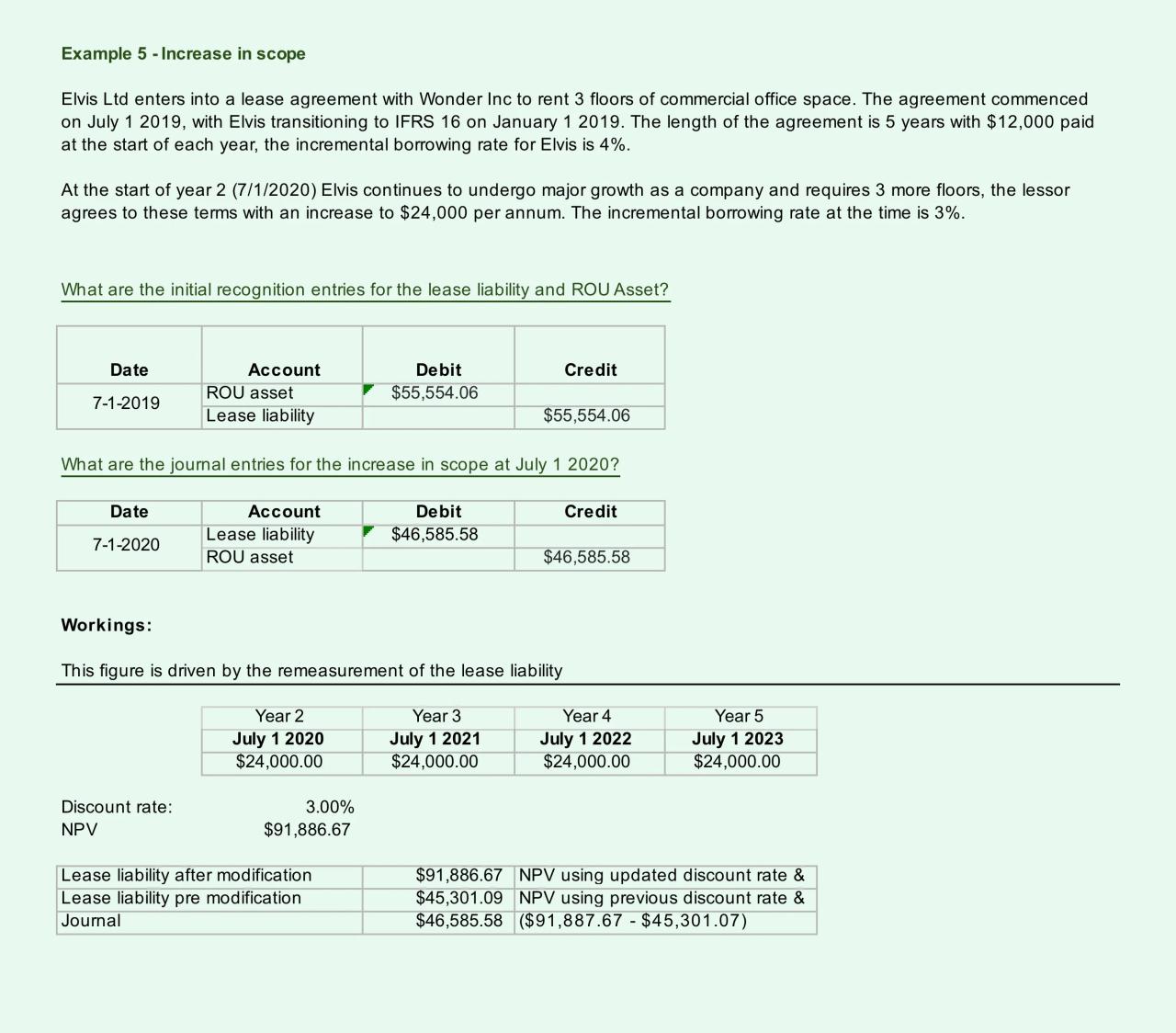

To illustrate the modified retrospective approach, consider the following example:

In 2023, Company A decides to adopt the new lease accounting standard, which requires the company to capitalize all leases on its balance sheet. Prior to 2023, Company A had been following the old lease accounting standard, which allowed the company to classify some leases as operating leases.

As a result of the change in accounting method, Company A must restate its financial statements for 2022 and 2021.

The following table shows the impact of the change in accounting method on Company A’s financial statements:

| Financial Statement | 2022 | 2021 ||—|—|—|| Assets | $1,000,000 | $500,000 || Liabilities | $500,000 | $250,000 || Net income | $100,000 | $50,000 |

As you can see, the change in accounting method has a significant impact on Company A’s financial statements. The company’s assets and liabilities have both increased, and its net income has decreased. The cumulative effect of the change in accounting method is reported as an adjustment to the beginning retained earnings of 2021.

Disclosure Requirements for GAAP Departure for Leases

Companies that depart from GAAP for lease accounting are required to make certain disclosures in their financial statements. These disclosures are intended to help users of the financial statements understand the impact of the departure from GAAP on the company’s financial position and results of operations.

The following are the minimum disclosure requirements for a GAAP departure for leases:

- A description of the reasons for the departure from GAAP.

- A description of the alternative accounting principles that are being used.

- A quantitative reconciliation of the differences between the company’s financial statements prepared in accordance with GAAP and the company’s financial statements prepared in accordance with the alternative accounting principles.

- A discussion of the impact of the departure from GAAP on the company’s financial position and results of operations.

Example Disclosure Note, Gaap departure for leases example

The following is an example of a disclosure note that would be included in the financial statements of a company that has departed from GAAP for lease accounting:

Departure from GAAP for Lease Accounting

The Company has elected to depart from GAAP for the accounting of leases. The Company believes that this departure from GAAP is necessary to provide a more accurate representation of the Company’s financial position and results of operations. Under GAAP, the Company would be required to capitalize all leases and recognize lease expense over the life of the lease.

However, the Company believes that this approach does not accurately reflect the economic substance of its leases. The Company’s leases are typically short-term and do not transfer ownership of the leased assets to the Company. As a result, the Company believes that it is more appropriate to expense lease payments as incurred.

The following table reconciles the Company’s financial statements prepared in accordance with GAAP to the Company’s financial statements prepared in accordance with the alternative accounting principles:

GAAP Alternative Accounting Principles Assets $1,000,000 $900,000 Liabilities $500,000 $400,000 Net income $100,000 $120,000 The departure from GAAP has a material impact on the Company’s financial statements. The Company’s assets and liabilities are lower under the alternative accounting principles than they would be under GAAP. This is because the Company is not capitalizing its leases under the alternative accounting principles.

The Company’s net income is higher under the alternative accounting principles than it would be under GAAP. This is because the Company is expensing lease payments as incurred under the alternative accounting principles, rather than recognizing lease expense over the life of the lease.

Essential FAQs: Gaap Departure For Leases Example

What is the primary reason for a company to depart from GAAP for lease accounting?

Companies may depart from GAAP for lease accounting to better reflect the economic substance of their lease transactions and improve the comparability of their financial statements with those of their peers.

What are the potential risks associated with GAAP departure for leases?

GAAP departure may result in increased complexity in financial reporting, reduced comparability with other companies, and potential scrutiny from regulators or auditors.

Can you provide a specific example of a company that has departed from GAAP for lease accounting?

Apple Inc. is a well-known example of a company that has departed from GAAP for lease accounting. In 2018, Apple adopted IFRS 16, which requires lessees to recognize lease liabilities and right-of-use assets on their balance sheets.